J Wood Insurance Blog

|

This is about you and your behavior. Why not learn how to save thousands of dollars by learning how to make yourself more attractive to insurance companies? This is not an article to help you save a couple dollars while you shop. This article will help you see savings over the long term. Honestly, you will be buying insurance for the rest of your life. Many customers already understand this when looking at their credit but overlook the idea when it comes to their insurance. I see people make these mistakes every day and hopefully after reading this article you will no longer be one of them. Insurance is a necessary expense, but that doesn't mean you have to overpay for it. As someone who works in the industry, and consistently saves on insurance year after year, I'm here to share my secrets with you. Here are some of the most effective ways to save money on insurance over the long term without sacrificing coverage. Shop regularly but do not move to new companies often. It's important to shop for insurance regularly, but don't be too quick to jump ship to a new company every time you find a slightly better rate. Remember, insurance is a for-profit business, so if a company thinks you are going to stay awhile then they are more inclined to give you their most competitive rates. Insurance carriers place value on policyholders who have shown some longevity with a company, so it's worth staying put if you're already getting a good rate. However, it's still important to shop around to see how much you're paying compared to other companies. If you can save a large amount then it is a no brainer, if it is only a little bit then you should seriously consider showing a little loyalty. Shop with a broker or independent agency. Nobody knows the individual insurance companies as well as the agent who works with them and sells their products every day. A broker or independent agency can be your best friend when it comes to finding the right insurance company. These professionals know the industry and can help you find the best company for your specific situation. For example, if you're married with children who drive, you may fit better with Company X as opposed to Company Y, who is better with insurance for couples without children. Shopping with "Captive Agents" (agents who only sell one company like State Farm or Farmers) shouldn't be ignored, they can sometimes be competitive and some people will always fit with what they are good at, but BEWARE. If your rate goes up they have no option to help you save other than diluting your coverage or raising your deductible. We would love to help you. Get a quote here. Carry higher coverages. Carrying better liability coverage can actually lead to better rates. Insurance carriers place the least value on policyholders who always move because of price. Carrying higher coverages suggests that you care more about coverage than price, which can make you more attractive to insurance carriers. Carrying minimums can cost you long term, not to mention how poor your policy is if you do have a claim. Some companies even sell higher liability coverage for cheaper than buying a minimum coverage policy. Avoid frivolous claims. Insurance is not a maintenance program. It was built for major occurrences, not a blown tire or to get your car towed every time it breaks down, so don't make claims for small things like getting a tow. Prior claims, even small ones, can count against you (yes, even getting a tow or using your roadside assistance) and cost you thousands per year in higher costs. If you know you will need something like a warranty for your home or your automobile or AAA for towing, buy those separately and keep those little claims off your record. Don't let your insurance lapse and Make Sure You Pay ON TIME Insurance companies place value on policyholders who keep their policies over the whole term and carry continuous insurance. The longer the better and make sure your not constantly paying late or at the last minute. Think about it, it is an added cost to the insurance carrier to constantly have to chase you down for a payment and do not think they have not calculated that into their overall cost for each consumer. If you show a history of this, you will experience a higher rate than those who pay on time and many companies will not even work with you. If you're between cars, you can buy a non-owned operator-only policy to keep your continuous insurance while you look for a new car. Protect your credit. Your credit can seriously affect what companies will accept you and how competitive the rates they offer are. Many of the most affordable insurance companies will not even offer you a quote if you have poor credit, so you are fighting an uphill battle already. Insurance companies often do a soft pull of your credit (they all do it so don't let someone tell you they don't), so it's important to keep your credit score in good shape. If you don't have good credit or you are young and haven't established credit yet, think about finding a professional to help you build or repair your credit. It can save you a ton of money over the long term to do so. Use telematics. Telematics is the use of technology to monitor driving behavior. Many insurance companies offer telematics programs that can provide discounts for safe driving. Telematics looks at how many miles you drive, what time of day you drive, hard breaking, fast acceleration, speeding, and phone use while driving. No one likes being tracked, but be honest with yourself. If you own a smartphone then you are already being tracked. Why not use it to your advantage to save money? Driving your best for a few months can make you more attractive to insurance carriers as it shows that you're a safe driver. Customers who utilize telematics often save as much as 35% compared to customers who refuse. Avoid tickets and accidents. This may seem obvious, but tickets and accidents, even if they're not your fault, can stay on your record for up to 5 years depending on the company. Safe driving and avoiding accidents and tickets can help keep your rates low. Finally, have a relationship with your insurance agent. Everyone should have an agent. Think about it. Would you go to court without a lawyer? Would you navigate selling your home without a realtor? And you pay for their services. An agent is available at no added cost. Why wouldn't you tap into a huge resource like an insurance agent? Someone who knows insurance and is always seeing what the current rates are. They can work with you over the long term to help you keep your rates down and find the best coverage for your needs. By working together, you can ensure that you have the coverage you need at a price you can afford. By following these tips, you can save a bundle on your insurance year after year. Shop regularly, but do not move to new companies often. Shop with a broker or independent agency to find the best rates and coverages for your specific situation. If you can, carry higher coverages to show that you care more about coverage than price. Avoid frivolous claims and don't let your insurance lapse. Protect your credit, use telematics, and avoid tickets and accidents. If you ever want a no obligation quote or just want some more advice about insurance in general, please feel free to reach out. We will do our best to help whether you work with us or not. You can reach us here or request a quote here.

0 Comments

General liability insurance is a crucial component of any business's risk management strategy, but misclassifying your business activities or underestimating the risk associated with your operations can have significant consequences. That's why it's crucial to discuss your business insurance needs with a professional at J Wood Insurance, who can help you correctly classify your business and ensure that you have the appropriate coverage.

Misclassifying on a general liability policy means you're not providing accurate information about your business activities. This can result in insufficient coverage that could lead to financial losses in the event of a claim. Underestimating the risks associated with your operations can also result in misclassification, which could leave you underinsured and expose your business to significant liability. At J Wood Insurance, our team of experienced insurance professionals can help you assess your risk level and recommend the appropriate coverage options for your business. We understand the importance of accurate risk assessment and appropriate coverage. By partnering with us, you can ensure that you have the right coverage to protect your business and avoid potential gaps in coverage or policy cancellation. In addition to providing accurate information about your business activities, working with a professional at J Wood Insurance can also help you avoid higher insurance premiums. We work with multiple insurance carriers to provide you with the most competitive rates available while ensuring that you have adequate coverage. To ensure that your business is adequately protected, it's essential to discuss your insurance needs with a professional at J Wood Insurance. Our team can help you navigate the complex world of business insurance, from correctly classifying your business to selecting the appropriate coverage options. We're always available to answer any questions or provide guidance on your insurance needs. Misclassifying on a general liability policy can have severe consequences, which is why it's crucial to discuss your business insurance needs with a professional at J Wood Insurance. Our team of experienced insurance professionals can help you correctly classify your business and ensure that you have the appropriate coverage to protect your business from potential losses. Contact us today to schedule a consultation and learn more about how we can help you with your business insurance needs. Why Liability Protection on Your Auto and Home Policy is Vital: A Guide from J Wood Insurance2/22/2023 Protecting your assets is crucial in today's world. You may not realize it, but your home and car are probably some of the most significant investments you have made in your life. You may have worked hard to save up for these assets, so it's essential to protect them from any potential loss. That's where insurance comes in. Home insurance, auto insurance, business insurance, and umbrella insurance can all help to protect you from financial ruin in the event of a liability claim.

At J Wood Insurance, we understand the importance of protecting your assets, which is why we offer comprehensive insurance policies that cover a wide range of potential liability claims. Our policies can help protect you and your family from financial loss and provide peace of mind in case the unexpected occurs. Home Insurance Your home is probably your most significant investment, and it's essential to protect it from any potential damage or loss. A home insurance policy can help cover the cost of repairing or replacing your home if it is damaged or destroyed by a covered peril, such as a fire or natural disaster. Additionally, home insurance can help cover the cost of personal property damage or loss, liability claims, and medical expenses. Liability protection on your home insurance policy is crucial, as it can protect you from financial ruin in case of a lawsuit. For example, if someone is injured on your property and decides to sue you, your liability coverage can help cover the cost of legal fees and any damages awarded to the injured party. Auto Insurance Auto insurance is mandatory in most states, but it's not just a legal requirement – it's essential for protecting your assets. Car accidents can happen to anyone, and they can be costly in terms of property damage, medical expenses, and liability claims. A good auto insurance policy can help cover these costs and provide you with peace of mind when you're on the road. Liability protection on your auto insurance policy is especially important. If you are at fault in an accident and someone is injured or killed, your liability coverage can help cover the cost of legal fees and any damages awarded to the injured party. Business Insurance If you own a business, you need to protect your assets from potential liability claims. Business insurance can help cover the cost of property damage, theft, liability claims, and other unforeseen events that could cause financial loss to your business. Liability protection on your business insurance policy is especially important, as it can protect you from financial ruin in case of a lawsuit. Umbrella Insurance Umbrella insurance is a type of insurance that provides additional liability coverage beyond what is provided by your home, auto, or business insurance policies. It can help protect you from financial ruin in case of a catastrophic liability claim. For example, if you are at fault in a car accident, and the damages exceed your auto insurance policy's liability limit, your umbrella insurance can help cover the difference. Why Choose J Wood Insurance? At J Wood Insurance, we offer comprehensive insurance policies that provide the protection you need to safeguard your assets. We work with multiple insurance carriers to provide our clients with the best coverage at the most competitive rates. Our team of experienced insurance professionals can help you understand the coverage options available and tailor a policy to meet your specific needs. In conclusion, liability protection on your home and auto insurance policies is essential to protect your assets from potential financial loss. Additionally, business insurance and umbrella insurance can help protect your business and provide additional liability coverage. At J Wood Insurance, we understand the importance of protecting your assets, and we offer comprehensive insurance policies that provide the coverage you need to have peace of mind. Contact us today to learn more about our home insurance, auto insurance, business insurance, and umbrella insurance policies. Locust Grove, Georgia is a small city located in Henry County, about 30 miles southeast of Atlanta. Despite its small size, Locust Grove has a rich history, diverse community, and plenty of attractions and amenities for residents and visitors alike. In this article, we'll explore 9 reasons why Locust Grove, Georgia is worth checking out. Historic Downtown Locust Grove's downtown area is a charming and historic district that offers a unique shopping and dining experience. Many of the buildings in downtown Locust Grove date back to the early 1900s, and have been beautifully restored and repurposed. You can find a variety of locally owned businesses, such as antique shops, art galleries, and restaurants, that add to the small town charm. Tanger Outlets Locust Grove is home to one of the largest Tanger Outlet shopping centers in Georgia. The center features over 80 stores, including major brands such as Nike, Adidas, and Under Armour. If you're looking for a bargain, you can find great deals on designer clothes, accessories, and home goods. Georgia Renaissance Festival The Georgia Renaissance Festival is an annual event that takes place in Locust Grove over several weekends in the spring. The festival features live entertainment, jousting tournaments, crafts, and food. Visitors can step back in time and experience life in a medieval village. The Cotton Fields Golf Club The Cotton Fields Golf Club is a public golf course that features 18 holes and beautiful views of the surrounding countryside. The course is challenging, yet enjoyable for golfers of all skill levels. The club also offers a driving range, practice greens, and a pro shop. French Market & Tavern The French Market & Tavern is a popular restaurant in downtown Locust Grove that serves delicious French-inspired cuisine. The restaurant is housed in a beautifully restored historic building and features a cozy atmosphere and outdoor seating. The menu includes classic dishes such as escargot, steak frites, and mussels. Lake Horton Lake Horton is a peaceful and scenic lake located just outside of Locust Grove. The lake is surrounded by woods and offers opportunities for fishing, boating, and hiking. There is also a picnic area and a playground for children. Skydive Spaceland Atlanta For the adrenaline junkies out there, Skydive Spaceland Atlanta offers an unforgettable experience. You can jump from a plane and enjoy a bird's eye view of the countryside as you free fall through the sky. The company also offers training courses for those interested in becoming certified skydivers. Veteran's Wall of Honor The Veteran's Wall of Honor is a tribute to the men and women who have served in the United States Armed Forces. The wall is located in the heart of downtown Locust Grove and features the names of over 1,400 veterans who have ties to Henry County. It's a great place to pay your respects and reflect on the sacrifices made by our nation's heroes. Community Events Locust Grove is a tight-knit community that hosts a variety of events throughout the year. These events include a Fourth of July celebration, a Christmas parade, and a farmers market. The city also has a vibrant arts scene, with community theater productions and art exhibits. Lastly, if you're a resident of Locust Grove or plan to visit soon, it's important to ensure that you have the right insurance coverage. That's where J Wood Insurance comes in. They offer a range of insurance products, including auto, home, life, and business insurance, to help protect you and your assets. Their knowledgeable and friendly agents can work with you to find a policy that fits your unique needs and budget. So, whether you're a local resident or just passing through, don't forget to reach out to J Wood Insurance for all your insurance needs. In conclusion, Locust Grove, Georgia may be a small city, but it has a lot to offer for both residents and visitors. Its historic downtown, diverse shopping and dining options, outdoor recreation opportunities, and unique attractions such as the Georgia Renaissance Festival and the Veteran's Wall of Honor make it a worthwhile destination. It's also located in a convenient location just a short drive from Atlanta, which makes it a great day trip or weekend getaway. Whether you're interested in history, outdoor activities, or just enjoying the charm of a small town, Locust Grove is definitely worth checking out. And with J Wood Insurance providing top-notch insurance coverage, you can rest easy knowing that you're protected. So why not plan your visit to Locust Grove today and experience all that this charming city has to offer?

Have you found yourself recently engaged? If so, we’d like to say two things: “Congratulations!” and, “Where in McDonough, GA is it going to be?” Choosing a venue for your wedding is not something to take lightly. Most couples know this already, which is why they typically take at least a full year to plan their big day. There’s a couple of practical reasons for enduring that long of a wait. Not only do you have to find the perfect place to hold this event, but when you do find it, you must book it well in advance to secure the calendar date you want the most. If you or your fiancé is a resident of McDonough, GA or somewhere close by, you may be considering this beautiful town for your wedding. In that case, you’ve chosen well. Even though it’s small, McDonough offers a wide range of options for wedding venues to fit any budget or style of wedding. The perfect place is here, waiting for you to discover it. Allow us to help ease the process of discovering the perfect wedding venue in McDonough by showing you four venues that are the best of the best MB Event Lounge What if you could choose a venue that could provide just about everything you could ever need for your small wedding or wedding reception, from decorations to event planning to a DJ? At the MB Event Lounge, that’s exactly what you get. Located at 1352 McDonough Pl, this venue is touted as an upscale, indoor event center with so many options for extra services, it will make your head spin. Need party supplies? MB Event Lounge rents those out. Want a customized layout for your reception in the banquet hall? That’s available, as well. Event planning? Don’t sweat it. And if you need help choosing a local vendor to provide food or entertainment, they can help with that, too. Gallery At Hood Street If you or your fiancé is an art lover, then you may love the Gallery at Hood Street. This exceptional venue at 136 Hood Street boasts three separate areas where you can hold a wedding ceremony and/or reception: the Gallery, the Warehouse, and the Lawn. Both the interior areas are lit by Edison-bulb chandeliers and feature exposed brick walls. This lends them a bright, open atmosphere that is ideal for exchanging vows, dancing your first dance as a married couple, and sampling catering from local vendors. Meanwhile, outside, you’ll find a deck as well as a lush green expanse of grass that can fit up to 200 guests, with patio string lights overhead. The Gallery at Hood Street isn’t just a venue, though. It truly is an artist’s gallery, which you can admire in the room that shares the same name (or pay an extra fee to have them removed for your event). As you can tell, when we describe the Gallery at Hood Street as, “exceptional,” we mean it wholeheartedly. You couldn’t pick a more beautiful place in town to celebrate your special day. Hazlehurst House The Hazlehurst House is one of McDonough’s treasures - not just as a wedding venue, but as a piece of local history. Built in 1829, this stunning vintage mansion has been repurposed into a full-fledged event center with modern conveniences. Not only is it all-inclusive (even going so far as to provide you with a list of preferred decorators and photographers), but it also offers many different on-site locations to choose from to hold your ceremony and reception. For example, you could choose to hold your ceremony out on the Veranda, in front of the house, or in the gardens; or inside the house in front of the historic fireplace, the Grand Ballroom, or the Magnolia Ballroom. Which areas you choose will depend on the size of your guest list, as well as your preference for indoor or outdoor festivities. But one thing you can be sure of: no matter where you go, you’ll always find beauty and elegance. Holding your wedding at the Hazlehurst House is a one-of-a-kind experience you’ll find only in McDonough. Refinery Hill Refinery Hill’s name suits it perfectly. The venue, located on a sprawling vineyard on 500 Pullin Rd in McDonough, offers just about the most refined wedding experience in the area. Not only can you book the entire Refinery Hill facility, including the barn with its beautiful tables and chairs, and various styles of elegant decor, but you can also book a wine tasting room. You’ll also have the option to have the in-house executive chef craft a delicious farm-to-table meal for you and your guests, complete with hors d'oeuvres and multiple courses. For fine dining, an incomparable outdoor location, and an atmosphere that is somehow both upscale and down home, booking your wedding ceremony and reception at Refinery Hill may just be the best decision you’ve ever made. Wedding Insurance

There’s one other important thing you need to take care of for your wedding, preferably as early as possible. And that is wedding insurance. You may never have thought of purchasing a wedding insurance policy before. But it’s a wise idea, especially if you’re like most couples in the US and plan to spend upwards of $20,000 on the event (believe it or not, the average cost of weddings in the US in 2022 was around $27,000). Wedding insurance will cover things like and is usually very inexpensive:

If you’re having your wedding in McDonough, GA, then it makes sense to go to a local expert for insurance. At J Wood Insurance, we can recommend and set you up with a policy that matches both the needs of your event and the needs of your wallet. Contact us today to learn more and get a free quote! Are you looking for a great place to fish near McDonough, GA or Locust Grove, GA? You’re in luck because Henry County is home to some prime fishing spots that locals have come to know and love! Before we tell you where those spots are, here’s some important information you need to know about legally fishing in Henry County, GA. Fishing Permits And Licenses In Henry County GA Anyone who fishes in Henry County must have a fishing license. You can apply for one on the official Georgia Natural Department of Resources website, here. To access Henry County’s reservoirs where public fishing is allowed for most of the year, you need to apply for an Authority Reservoir use permit. You can obtain this permit at the office of the Henry County Water Authority, located at 1695 Hwy. 20 West, McDonough, GA. In addition to the reservoir permit, you must present a valid form of photo ID to the reservoir attendant when you sign in. There are a few lakes on our list that are only accessible to residents of the neighborhood where they are located. If you haven’t yet moved to the McDonough or Locust Grove areas, this article may help you make your decision! Who doesn’t want to live next to a lake where they can fish every day? Of course, if you know someone - a friend or family member, for example - who lives in one of these neighborhoods, they may be able to give you access to the lake for fishing. Just be sure you have your license with you. Now, on to the 6 best places to cast your line in Henry County, GA! Tussahaw Reservoir The Tussahaw Reservoir is one of three piers open to public fishing in Henry County. Here, you’ll find bass, bream, and catfish in a diverse range of species. Located about 20 minutes from McDonough and 15 minutes from Locust Grove, the reservoir is within easy driving distance regardless of which of these towns you live in. It’s open Wednesday, Friday, Saturday, and Sunday from 7:00 AM to 7:00 PM for the regular fishing season, which starts in March and ends in November, and the winter fishing season, which lasts from December to February of the following year. Before you visit this fishing spot, be sure you’ve got both your fishing license and your Authority Reservoir use permit! You can get the latter at the Henry County Water Authority office in McDonough. Upper Towaliga Reservoir Upper Towaliga is the second reservoir located in Henry County. Large and teeming with fish, you’ll find this is a popular fishing spot to catch bass, bream, and catfish. Along with green grassy banks where you can cast your line into the blue-green waters of the reservoir, Upper Towaliga also has its own boat launch and a floating deck with a handicap-accessible ramp. Upper Towaliga has the same public fishing schedule as the Tussahaw Reservoir. Once again, you’ll need an Authority Reservoir use permit to fish here, as well as your fishing license. Salem Park Situated in McDonough, GA, Salem Park is a recreational hub for city residents and their families. Not only does it have walking trails, playgrounds, and soccer and baseball fields, but it also features a fishing pond! It is important to note that the fishing pond in Salem Park is catch-and-release only. So, you won’t be able to catch your lunch here. But still, it’s a great place to go to spend some quiet time fishing by yourself or to teach your little ones how to angle. Don’t forget to bring some rice or frozen peas for the ducks! Boyds Lake You’ll find Boyds Lake just a few miles from McDonough. This quiet reservoir is populated with a wide variety of fish, including bass, bream, catfish, perch, and trout. It is located in a private residential neighborhood, so you will either need to live nearby or know someone who does before you can fish. Green Valley Lake If you live by Green Valley Lake, you’re right next to a beautiful fishing spot! Here, anglers have been known to catch bass, bluegill, catfish, and crappie. It’s just 1.8 miles from McDonough, GA proper. You can even walk there if your neighborhood is close enough! Skyland Lake If you love fishing and you’re looking for a place to live in or near Locust Grove, GA, you should consider the neighborhoods surrounding Skyland Lake. From there, you can take a short walk to the lakeside in the mornings or in the late afternoon right after work, cast your line, and catch bass, catfish, crappie, perch, and trout. It’s also the perfect place to go on the weekends for some much-needed rest and relaxation. Just as there are many different types of fish to catch in Henry County, there are many types of insurance policies to sign up for, as well! Be sure to contact J Wood Insurance for all your insurance needs, whether it’s auto, home, life, or business.

When you’re looking for places to eat in McDonough, GA, you may be surprised to learn how many great options are out there! In fact, there are so many options in such a wide variety of cuisines - American, Indian, Italian, Thai, and more - that you may find yourself in a quandary as to which place to try first. Let us help you decide where to go out to eat by sharing the 8 places we feel are some of the best restaurants in McDonough, GA. Pasta Max CafePasta Max Cafe on Griffin Street is a cozy, intimate spot that McDonough residents love to go to experience authentic Italian dishes. From fettuccine alfredo and black pepper pappardelle, to sandwiches, steamed mussels, and cheesy gooey pizza, there’s something for everyone at this restaurant. And in case you’re skeptical, just know that Pasta Max Cafe has a 4.6 rating on Google from over 900 reviews! Clearly, there’s something in the sauce that keeps people coming back for more. Leo's CafeLeo's Cafe on Racetrack Road in McDonough, is a great little diner that stays packed for a reason. The portions are huge and the food is always cooked to perfection. They are open for breakfast and lunch, the menu selection is wide and varied, and the service is outstanding. The best part is the owner himself, Leonardo (tell him we said to call him DaVinci ;) ). Leo is a first generation immigrant living the American dream and he is the salt of the earth, always delivering service with a smile. If you eat here you are guaranteed to see him or his brother and if you come more than once he will probably know you by name. GRITZ Family RestaurantFor Southern food fare with a family-friendly atmosphere, you can’t get any better than GRITZ Family Restaurant. This eatery was featured as a Tripadvisor Travelers’ Choice, which is a title that the website Tripadvisor hands out to locations that consistently receive positive reviews. GRITZ is definitely one of our top choices. It’s the best place in town to visit for a home cooked meal at breakfast (which they serve all day) and lunch. On their menu, you’ll find lots of Southern favorites, including corned beef hash, pecan pancakes, country fried steak, chicken and dumplings, and grilled Cajun chicken sandwiches. Go on and give them a try! On The BayouHungry for a taste of Cajun and New Orleans-inspired seafood? Then On the Bayou is the place you want to be! Locals love to eat their seafood gumbo, oyster plate, mac and cheese, fried ribs, gator bites, and, for dessert, sweet snowballs. The restaurant’s delicious food and upbeat atmosphere has earned it an excellent 4.7-star rating on Google from more than 100 reviewers Red Orchid Thai CuisineRed Orchid Thai Cuisine has long been a staple of Southeast Asian food in McDonough since 2009. Family owned and operated for the last 13 years, this restaurant has made its name by serving tasty, authentic Thai dishes like stir fry, curry, dumplings, spring rolls, fried rice, and steak. Reviewers on Google rave about how delicious the food at Red Orchid Thai Cuisine is, and we couldn’t agree with them more! Masala CottageWe love Indian food in McDonough, which is why it’s a good thing we have the best Indian restaurants in Henry County! Masala Cottage, open for lunch and dinner, features a menu full of traditional Indian dishes, such as tikka masala, curry, saag, and more, in a wide variety of meats (chicken, fish, goat, lamb, and shrimp). On the side, you can savor hot, fresh naan and sample an array of chutneys. We’ve only scratched the surface of what Masala Cottage has to offer. To experience the full breadth of it, you have to go there yourself! El Sarten LatinoEl Sarten Latino brings a taste of Latin America and the Dominican Republic straight to McDonough, GA residents’ mouths! Located in the McDonough Place Shopping Center, this fantastic local restaurant serves breakfast, lunch, and dinner every day of the week except Sunday. Its central location makes it the ideal stop for a flavorful meal in between work or shopping. When you go, you can pick up a plate and make your way through the buffet brimming with mouth-watering eats, or order something equally delicious off the menu, like traditional Dominican spaghetti, picadera, fried pork, fried green plantains, stewed beef, and rice pudding. If you have any old favorites from Latin/Dominican cuisine, you’re sure to find them here! Crust And Craft McDonoughIf you’re craving craft pizza with draft beer or a cocktail, then you should give Crust and Craft a try. You can always order pizza or one of their scrumptious sides online, but we recommend going in person to experience the bustling, friendly atmosphere, hang out, and maybe even watch a ballgame on the TV by the bar. As you chat and connect with your fellow McDonough residents, you can sample their homemade pizzas with plain cheese and pepperoni, or you can go out on a limb and try some of their wild toppings, like Korean BBQ, Mexican street corn, truffle mushroom, and Cubano pie. You may just find a new favorite! Their sides and drinks menus are just as varied, with plenty of staples to keep you in your comfort zone as well as unique concoctions that you’ve probably never tried before. For something new or something familiar, you can’t beat Crust and Craft. Starshines CafeTo round out our list of best restaurants in McDonough, GA (which is by no means a full reflection of how many great places there are to eat in our fair city), we’d be remiss if we didn’t recommend Starshines Cafe. This delightful eatery - also known as “McDonough’s hidden treasure” - is run by a husband-and-wife team. This dynamic duo serves upscale dishes for brunch, lunch, dinner, and dessert in a charming, casual setting. Not only is the food delicious and varied, but each dish is plated with care and looks just as good as it tastes. Even more impressive, Starshines holds a 4.7 rating on Google from almost 300 separate reviews. We recommend reserving a table, since Starshines stays busy! The restaurants in McDonough, GA are proof that you don’t have to live in a big city to enjoy lots of different types of cuisines from all around the globe. While we put some of our favorites on this list, there are several other great places to eat in McDonough, as well. Go exploring and see what you can find!

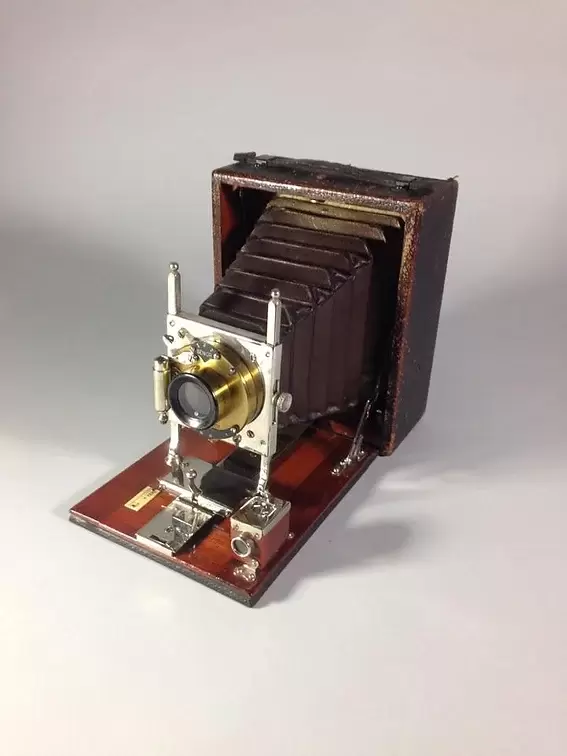

As you search for a great place to eat, know that there’s also a great place to shop for home, auto, life, and business insurance: J Wood Insurance! Click here to learn how you can contact us and find out about our range of policies. Recently moved to McDonough or Locust Grove, GA? You’re probably wondering what folks get up to around here for entertainment. If so, you’ve come to the right place! At J Wood Insurance, we don’t just provide home, auto, life, and business insurance policies to Georgia residents. Since we’re headquartered in McDonough in Henry County, just fifteen minutes from Locust Grove, we also know the best places in both towns to hang out, play, and relax. Without further ado, here are the top 6 things to do in Locust Grove, GA and McDonough, GA. Noah’s Ark Animal Sanctuary If you have kids, or you just love animals, then you’ll want to make it out to Noah’s Ark Animal Sanctuary in Locust Grove. Here, across 250 acres of land, you’ll see farm animals like cows, horses, and sheep, but also exotic mammals such as lions, tigers, and bears (oh my!). Wait a minute, you say. Georgia isn’t a jungle! Well, you’re right, but some people across the United States still manage to get a hold of wild animals from overseas and bring them home. Some of these critters end up being abused by their new owners, which is how they end up in the Noah’s Ark Animal Sanctuary. The sanctuary is a non-profit organization that doubles as an animal rehabilitation center. Their job is to see to it that these incredible creatures have the best life possible. At the same time, they make it their mission to educate children and adults on the wonders of the animal kingdom. It’s one of the best attractions that Henry County has to offer. https://noahs-ark.org/ Escape The Museum Do you love history and escape rooms? Even if you prefer one over the other, you’ll still find Escape the Museum in McDonough a pure delight. Officially, this attraction is a real life museum. Known as the Camera Museum, it displays antique cameras and takes visitors through the history of this all-important device. But the best part about it is it also doubles as an escape room. If you want, you can rent out the whole building to hold a private party for a birthday or a work field trip. The museum will even cater your event, if you wish, with craft beer and wine as beverages. Now those are things you won’t want to escape from! https://www.camera-museum.org/ Southern Belle Farm Who doesn’t love going out into the fresh Georgia air and enjoying the pastoral farmland and orchards that the state is so well known for? Fortunately for residents of McDonough and Locust Grove, Southern Belle Farm is located just minutes away from each town. On your visit to Southern Belle Farm, you’ll find all sorts of things to do to entertain you and your family. During the autumn, you can pick out fat, round pumpkins from the pumpkin patch and find your way out of a winding corn maze. In the summer, you can harvest your own Georgia peaches, along with other choice fruits. And of course, no matter what time of year you decide to visit, you can always shop in the Country Market, where you’ll find homemade preserves, seasonal produce, gifts, baked goods, and other delights. It’s the most authentic way to experience Georgia’s natural bounty. https://www.southernbellefarm.com/ The Honeycomb Cottage Looking for a place to unwind and have a little “you” time? If so, the Honeycomb Cottage is your number one destination in Locust Grove. The Honeycomb Cottage is a day spa with just about every form of pampering you could desire. Experience a soothing massage, seaweed wraps, facials, aroma therapy, and so much more. In addition to the spa, the Honeycomb Cottage also offers salon services like hair waxing and teeth whitening. Go in feeling stressed and rundown, and come out rejuvenated, radiant, and vital. https://thehoneycombcottage.com/ The Selfie Xperience Selfies are all the rage these days, especially among kids and young adults. If this is you and your family and friends, then you should visit the Selfie Xperience. The Selfie Xperience is the first interactive photo studio of its kind in Henry County. With 3700 square feet of space and countless selfie backgrounds and props to choose from, you’ll never have a better time snapping Instagram-worthy pictures than you will in this venue. That’s right, the Selfie Xperience is a venue. You can rent it out for birthday parties, work parties, a girls’ night out, or any type of event you can think of! It’s an unforgettable place that will make your time spent with family, friends, or coworkers that much more special (don’t forget to say, “Cheese!”). https://www.theselfiex.com/ Heritage Park Veterans Museum For history buffs, McDonough has one of the most fascinating attractions in the state: the Heritage Park Veterans Museum. This museum was first opened on Veterans Day in 2010. It features several different collections, including photos, dog tags, uniforms, and medals of US soldiers who hailed from Georgia. It even has a few military vehicles on display. The wars covered range from World War I all the way to present day - over a century of brave sacrifices made in the name of liberty, truth, and justice for our country. https://www.heritageparkveteransmuseum.org/ As you can see, there is a wide variety of fun things to do in McDonough, GA and Locust Grove, GA. We may not be as big as our big sister Atlanta, but there’s plenty of local charm, entertainment, and history to go around.

While you’re checking out this region, be sure to check into home, auto, life, and business insurance with J Wood Insurance! We serve all counties in Georgia, not just Henry County. Contact us here to get a quote on your new policy. If you made it here, I hope this helps you on your insurance journey. Some of this may not age well in this new world of high inflation but most will help you become a better and more judicious consumer. Cheers! 1. Liability coverage is the most important part of your policy.Sure, comprehensive and collision coverage is important for your vehicle, but a lot of people want to only buy the liability coverage that is mandated by the state. The difference between minimum coverage and 50/100 is often only 5 to 10 dollars per month more and gives double the coverage. Imagine your vehicle is involved in a serious accident and the driver of your vehicle was at fault. If the person in the other car was seriously injured and had to go to the hospital, the medical bills often would far exceed the 25,000 dollars in coverage that a minimum coverage policy would pay out. You could be left on the hook for the remainder of that person’s medical bills. My Recommendation: 50/100/50 liability protection should be as low as you go. You should explore higher coverages whenever you renew and if you are shopping make sure the agent doesn’t dumb down the coverage to make the sale. 2. Uninsured motorist/underinsured motorist coverage should be mandatory on every policy.We recently spoke with a customer who used to buy his insurance directly from the carrier. He didn’t understand the importance of uninsured/underinsured motorist, but he loved how cheap the policy was. After he was hit by another driver who was uninsured, he was left with a totaled vehicle and no payout from the insurance company. Uninsured/underinsured motorist covers you in case someone who does not have insurance should get in an accident with you or in a hit and run accident. My recommendation: Don’t cut corners on your auto policy. Always ask for uninsured/underinsured motorist and be wary of any agent or company that tries to sell you a policy with out this coverage. 3. Roadside coverage is great! But only if you barely use it!Roadside and towing coverage is a great add on to your policy but be careful how often you use it. Every time you use this service it can be considered a comp claim and can hurt your insurance score and cause your insurance premiums to be high. My Recommendation: If you use this coverage a lot because you have multiple cars then go ahead and get AAA. If you rarely need a tow then this can be an extremely cheap coverage for you. 4. Buying Direct Is Great For Insurance Companies And Terrible For You The Customer!It does not matter whether you buy your insurance directly or buy it from an agent, it will cost pretty much the same. So why wouldn’t you go with an agent? They are experts on what is in a policy and more importantly (if they are a good one), experts on the company they are representing. They can help you find the most value in a policy and warn you if something important is missing. Would you go to court without a lawyer? So why would you go around an agent when they are literally a free resource to you. A good agent can advise you on how to handle claims, help you with payments, get on the phone with the insurance carrier on your behalf if you have a problem, inform you whether something is covered with your policy and help you adjust your coverages so that they fit you and your needs. If you buy direct you are a number on a screen with no one to look out for you. 5. Understand the difference between a captive agent and an independent agent.A captive agent can only sell you one company. They represent some of the most well-known insurance companies out there (State Farm, Farmers, etc.) but they can only offer you one policy for one price. If you do not fit perfectly into their little box then you are out of luck, your agent can only offer higher deductibles or less coverage if your premiums are too high. There are some great captive agents out there, but why build a relationship and trust an agent who can only offer one product?

Alternatively, an independent agent contracts with many different insurance companies. They know what each company’s “appetite” is, which is insurance jargon for the type of customer that they prefer. They can work with you over the years and move you between companies as your life changes (get married, have kids, buy that new boat you always wanted, etc..) to keep your insurance rates down. A big gap in insurance coverage for most homeowners and renters is for personal property. A typical homeowners policy often has very limited coverage for theft of your most valuable personal possessions like your wedding rings, a valuable collection of guns, records, memorabilia, etc.

Always ask your independent agent these questions: 1. What are the limits of coverage for my personal property? This will encourage your agent to dig into the policy details with you and make sure you are covered. 2. Are there any upgrades to my policy that extend more coverage for my personal property? Many insurance companies have different levels of coverage that can be added for next to nothing extra and will be enough to give you the coverage you need. If not, they will offer a rider, which is like a small policy attached to your homeowners that will extend extra coverage to specific items. 3. Are there any special exclusions in this policy that is different than a typical HO3? Many insurance companies like to sneak in little exclusions (ex. they do not extend liability coverage for bites from one your dogs). You can work with your independent insurance agent to make sure there are no exclusions that may affect you. Always disclose what valuable items you own and their value during your homeowners insurance quote so that your independent insurance agent can help you compare policies and provide you a quote for an additional policy to cover these items if you do not have enough. Remember, your independent insurance agent is as big an asset to you as the policy you buy and their expertise is free! |

Contact Us(770) 322-4390 Archives

May 2023

Categories |

Providing home, auto, life, and business/commercial insurance in McDonough Ga, Locust Grove Ga, and all of Georgia.

Navigation |

Connect With UsShare This Page |

Contact Us |

Location |

McDonough Historic District, McDonough, GA, US photo by Bubba73 | CC-BY-SA-3.0 | Website by InsuranceSplash

RSS Feed

RSS Feed